LNN

Earnings Whisper ®

N/A

2nd Quarter February 2026

Consensus: $1.60

Revenue: $170.71 Mil

Latest EPS

Thursday, January 8, 2026

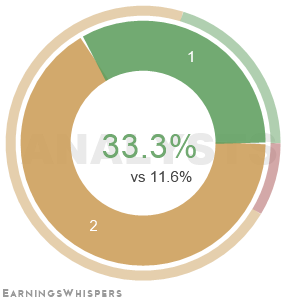

What do you expect when LNN reports earnings?

Where is LNN's stock price going from here?

Analysts

Pivots

Resistance

$129.00

$127.30

$126.01

Support

$123.01

$121.31

$120.02

Description

Lindsay Corp., being a pioneer in the automated irrigation industry, provides a variety of proprietary water management and road infrastructure products & services. It has 2 major reporting segments: Irrigation & Infrastructure. Irrigation unit is engaged in the manufacture and marketing of center pivot, lateral move, and hose reel irrigation systems and also manufactures and markets repair as well as replacement parts for irrigation systems & controls.?It strengthens irrigation product by introducing GPS tracking & guidance, variable rate irrigation, wireless irrigation management, irrigation scheduling, machine-to-machine communication technology solutions, and smartphone applications. It sells its irrigation products primarily to a world-wide independent dealer network. Infrastructure unit includes the manufacture and marketing of moveable barriers, specialty barriers, crash cushions and end terminals, road marking and road safety equipment, large diameter steel tubing, and railroad signals & structures.