MTN

$161.76

Vail Resorts

$6.95

4.49%

MTN

Earnings Whisper ®

N/A

2nd Quarter January 2026

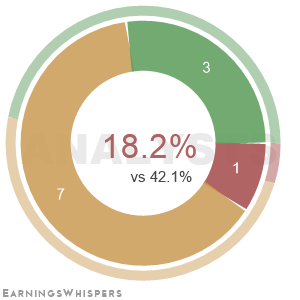

Consensus: $6.61

Revenue: N/A

Wednesday

Mar 11

4:05 PM ET

Guidance announcement made Wednesday, December 10, 2025

Latest EPS

Wednesday, December 10, 2025

What do you expect when MTN reports earnings?

Where is MTN's stock price going from here?

Analysts

Pivots

Resistance

$171.59

$166.98

$164.37

Support

$157.16

$152.55

$149.94

Description

Vail Resorts, Inc. holding company's operations are carried out by several subsidiaries and are clustered into three segments namely Mountain, Lodging and Real Estate. The Mountain segment operates mountain resort properties and urban ski areas as well as ancillary services like ski school, dining and retail/rental operations. The Lodging segment owns and manages luxury hotels under the RockResorts brand and condominiums around mountain resorts. The segment also operates concessionaire properties and mountain resort golf courses. The Real Estate segment owns, develops and sells real estate in and around the company's resort communities. Vail Resorts generates revenues from two segments - Resort and Real Estate. Under the Resort segment, the company has Mountain and Lodging services, and other as well as Mountain and Lodging retail and dining. Vail Resorts had completed the acquisition of Peak Resorts. With the completion of this buyout, the company added U.S. ski areas to its portfolio.